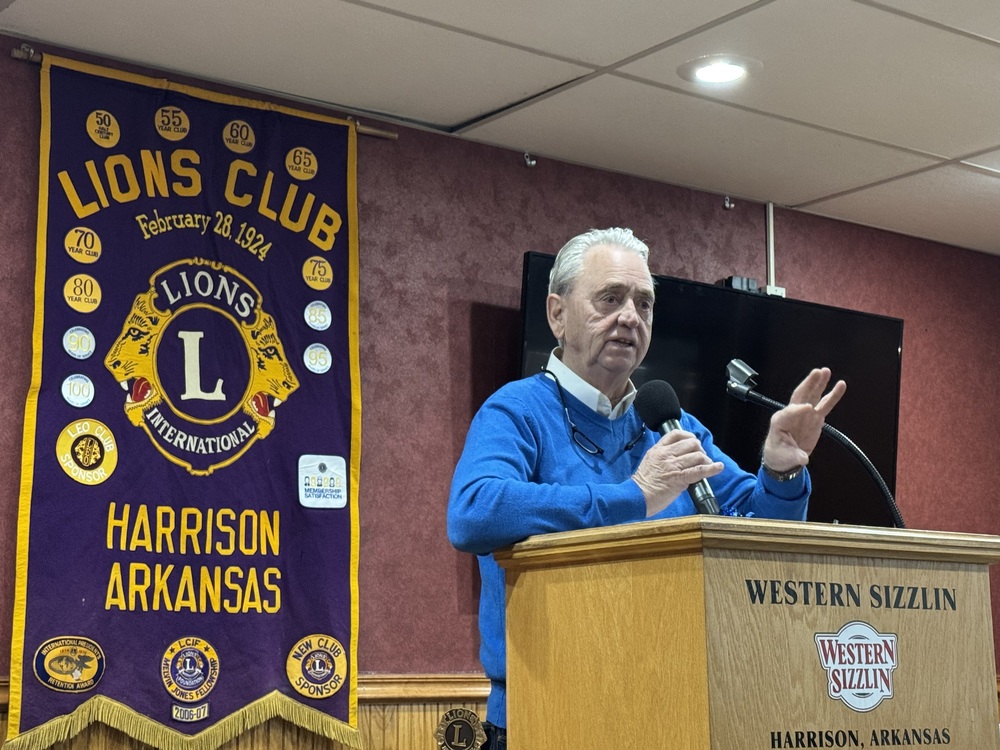

Last week, some Department Heads and Mayor Jerry Jackson were invited to speak to the Lions and Rotary Clubs about the upcoming March 3 vote to remove the sunset provision on two ordinances that have been in effect for decades.

The directors emphas

ized that the need for Police, Fire, and Infrastructure will always be there, and it’s time to make sure these taxes stay in place to ensure stable revenue.

ized that the need for Police, Fire, and Infrastructure will always be there, and it’s time to make sure these taxes stay in place to ensure stable revenue.

Mayor Jackson said, “Projects like the Creekside Community Center should sunset. Once that project is paid for, that tax will go away. But the services and expenses of operating top-notch police and fire departments should never go away.”

Fire Chief Marc Lowery explained that, with their current staff, equipment, and training, the Insurance Service Organization (ISO) has rated the department at 2, which saves home and business owners money on their insurance policies.

“It’s important that we keep this ISO rating. They look at so many details – even water pressure around town to make sure we can fight fires as needed. So infrastructure is important to the fire department, too,” Lowery said.

Lowery also shared that the equipment a firefighter needs to fight a fire costs $5,000 per person and is custom-fitted to each firefighter. The gear expires in 10 years.

Some recent projects the current sales tax has paid for are the new sidewalks, such as Capps Road and the Goblin Drive project.

“If we could have started the Goblin Drive project when we first wanted to, we could have saved a lot of money. But with the sunset clause in place, money had to be put back for the project since we couldn’t count on any dollars past the eight years,” Jackson said.

COO Wade Phillips explained that the sales tax on infrastructure brings in about $3.3 million a year and is the main source of funding for infrastructure improvements. The 2026 paving project will cost about $2 million. “Equipment is not built to last like it used to be. And we have some wastewater equipment needs that will be as much as $500,000 to replace.”

Phillips also told the civic groups that the ordinance for the infrastructure tax will automatically have 30% dedicated to pavement preservation. “This will help us maintain and improve the roads we have.”

Police Chief Chris Graddy told the group, “When I became police chief seven years ago, I could outfit a car for $9,000. Last year, it cost the department $19,000 to outfit a police vehicle. We want our officers to be protected with the equipment they need, including a bulletproof vest that costs $1,800 and has an average lifespan of five years. It’s costly to keep a well-trained police force, but we feel like our community and our officers should be taken care of.”

CFO Luke Feighert reminded the club members that Harrison still has the lowest sales tax rate of any city in Arkansas, with a population of between 10,000 and 20,000. “We are even lower than Branson. We are not asking for a tax increase; we are asking voters not to have to vote every eight years. That way, our department heads can plan, saving the City money.”

He continued, “I’m known for saying ‘No’ to the department heads when they ask for more money. But it’s my job to be fiscally responsible with the city’s finances. We continue to have clean federal and state audits each year. I’m not going to allow the City to spend money we don’t have. I think that’s what our City Council and taxpayers desire. We are good stewards of the tax dollars we receive. We want to continue funding the projects necessary for our community’s safety and quality of life. That’s what is right.”

If there are any questions, the department heads want to answer those questions for the citizens. Early voting begins Feb. 17 and Election Day is March 3, 2026.